And just like that, another year begins! Cast your mind back to the beginning of 2020. The world looked like a different place then, didn’t it? I’d be willing to bet you made some resolutions that, with the arrival and onslaught of the coronavirus pandemic, fell promptly by the wayside. We had bigger fish to fry all of a sudden, right? And the chances are that the financial goals you’d set yourself for 2020 were well and truly derailed.

You know what though? That might not be a bad thing. Sometimes, having the opportunity or the need to reexamine and evaluate your financial goals can be a blessing in disguise. Financial goals that you thought were easy to accomplish might have just been holding you back from greater things. More ambitious financial goals might have been unrealistic. They may have been stopping you from ever feeling good about your money and truly enjoying it.

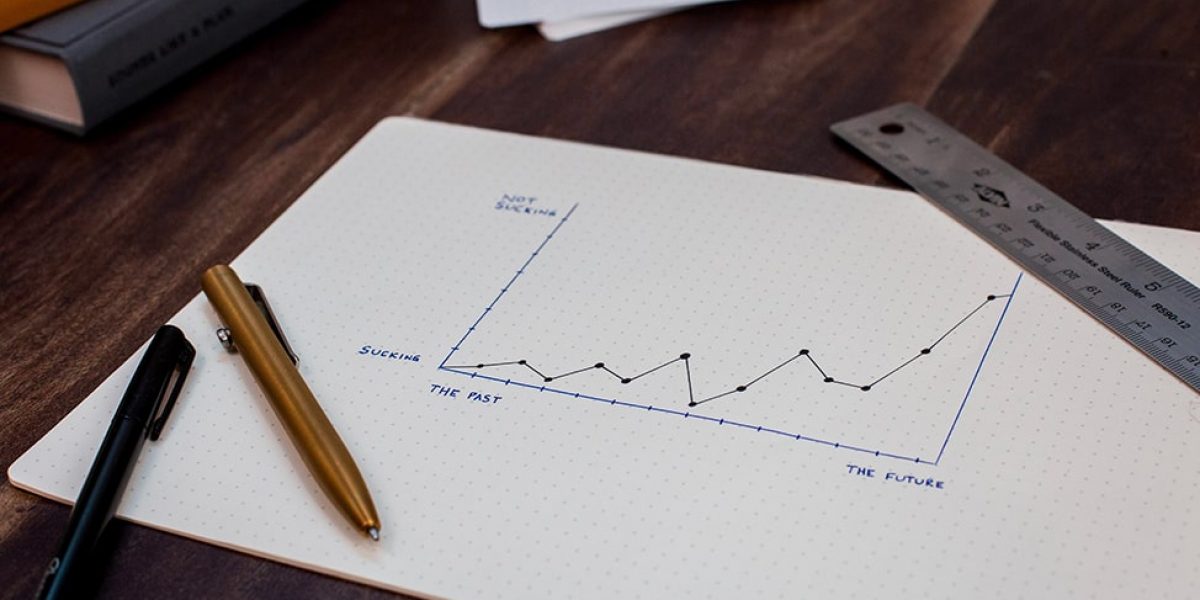

So welcome in a new year, and wave goodbye to the tatters of your old unrealistic and unhelpful financial goals. This is how to set realistic financial goals and how to achieve them.

Planning For The Unknown And Unexpected

It doesn’t help that setting goals can be difficult. You have to take so many uncertainties into account – market performance, future expenses, and what the life of your future self is actually going to look like. But as financial planners, we’re used to that. We can often see some of the challenges and pitfalls that might beset you, just thanks to our experience in the field.

Now to help you set your own financial goals, I’m going to give you a sneak peek into what those first steps with a client look like. I’m going to show you how we really drill down into their circumstances to find out what they really want their money to help them do, and to give them the life that they truly want and deserve.

To help my clients achieve their goals and plan for a financially secure future, this is the process we go through. If you go through these steps too, you’ll get much closer to setting achievable financial goals at any age.

1. What financial goals should you be planning for?

You’d be surprised how many of my clients come to me with a very narrow vision of their future and of what their money can do for them. They think, quite understandably, that the limits of the goals they should be setting are becoming mortgage-free, and having a good retirement fund. But there is so much more to it than that. Set personal goals of real accomplishment, and make your money work hard towards achieving them.

So ask yourself about more than just paying off the mortgage and saving for retirement. Start by asking: What is important to you? What do you want to achieve?

Put pen to paper, brainstorm a little. All of your life goals and targets can be affected by your financial plan, so while it may not look like a financial goal, your plan is going to support your journey towards achieving it. So to get yourself started with this task, here are a few key questions to ask yourself.

- Where do you see yourself in five years? What about in ten years’ time?

- Do you know what all your accounts are worth and where they are invested?

- Do you have children that you want to put through college? How will that be funded?

- What if something awful happened to you tomorrow? Do you have adequate insurance coverage? Are your final wishes memorialized in an estate plan?

- What does your ideal retirement look like? Do you want to travel? Upgrade or downsize your property? Spend more time with the family, or more time devoted to your hobbies and interests?

If you have a spouse, ask them the same questions and see how your answers overlap. It’s important that your financial plan allows you to achieve your individual goals as well as the goals for your family. It’s vital that you and your spouse are on the same page.

Try and rank those goals in order of importance. Then, give them a timeline. Some of these goals are going to become short-term goals, while others are long-term. They need to be approached differently. For example, if you’re using investment accounts to save, you might need to address your level of risk tolerance as you get closer to the day you’re going to need those funds.

2. Check that your goals are realistic

It’s all well and good (not to mention a very pleasant daydream) to imagine the retirement of a multimillionaire. You know, the beautiful house, the endless exotic vacations, and freeing up time to spend on the golf course or with family. But you’re going to need the retirement income to support that lifestyle.

If you want to send your kids to college, it’s no good dreaming about them getting into the best places with the costliest tuition fees if you don’t have a realistic way to fund it for them.

The best way to avoid unpleasant surprises, the traps left waiting for you by setting unrealistic goals, is to do your homework now. Use the tools available through your 401(k) investment platform to see where your retirement savings are heading. Think now about your health insurance; is it adequate, is there anything you can do to extend the coverage? Think about health saving accounts to boost your financial security.

And could you start paying into a 529 plan now to help save for future education expenses? Compare 529 plans state to state – you’re not confined to using one in your own state, or even in the state you’d like your child to go to college in.

Compare where you are today with what you’ll need in the future. You might need to start saving more aggressively or using different savings vehicles to achieve your goals. And it all might start to feel a bit overwhelming as there’s a whole lot to cover at this stage. You may want to consult a financial planner to help you to see the big picture, and to plan for all eventualities and needs.

3. How do you achieve your goals?

Now you’ve set your financial goals and you know they’re realistic – how do you achieve them? Well, you need to have an action plan, or as we here at Method call it, an implementation plan. This is a detailed roadmap, and it will get you to your destination. Everything requires action now – the long-term goals as well as the short-term goals – and the sooner you start following this personalized plan, the better.

Your implementation plan will include setting aside savings, adjusting investments, and creating good financial habits. It will include items you can check off now – setting up the right accounts, adjusting your asset allocation and so on – as well as setting up items for the future.

And you must check back in with your plan regularly. Create a goal chart or use a financial app to track your progress. If you need to make adjustments, do so. No financial plan is set in stone, and the best ones take into account the fact that life can throw you curveballs. Life can also throw you promotions, bonuses, raises; you need to review your financial plan regularly to make sure you’re making the best use of any changes that occur along the way.

Reach Out To A Financial Planner To Achieve All Your Financial Goals

As financial planners, we talk to our clients all the time about goals. We talk about setting goals, we talk about short-term goals, we talk about retirement goals. And we’re not slow to celebrate when clients achieve their goals either. In fact, that’s one of the best parts of my job.

Using a financial planner to help set your financial goals makes the process much easier and more realistic. We’re used to thinking about the challenges that you might encounter, and how to build in big expenses, as well as big dreams, to your financial plan. If you’d like to set up a meeting to discuss how to achieve your financial goals, please use my online form to book an appointment. I’ll be thrilled to hear from you.

Until then, wishing you all a very happy new year.